Table of Content

- Your total interest on a $1,000,000.00 mortgage

- What income do you need for a $800000 mortgage?

- How much income do you need to buy a $600000 house?

- How much income do you need to buy a $650000 house?

- What happens if i pay an extra $100 a month on my mortgage

- Monthly payments on a $1,000,000.00 mortgage by interest rate

- How Much House Can I Afford Based On Mortgage Payment

Interest is the fee you pay the lender for loaning you the money to buy the house. The idea here is similar to the interest payments you receive from a bank. The company that issues your annuity holds, uses and invests your money. In exchange, it gives you a rate of return and guaranteed payments. For annuities that pay on a fixed term , this is specifically structured like a loan.

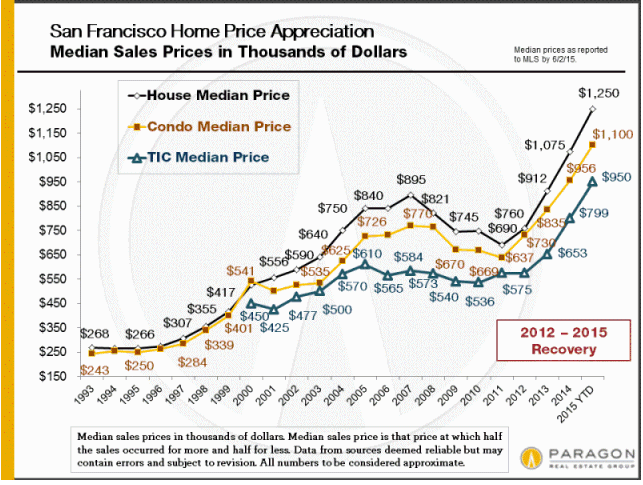

In either case, the only way to receive a conventional loan would then be to make a down payment of over $300,000 in some areas and over $500,000 in the rest. An annuity payment plan means that each year for 30 years or so, you'll receive a lump-sum payout, one installment from your lottery winnings. The Down PaymentAffordability is also based on your down payment. If dont have a sufficient down payment, that $1-million home is out of reach for the time being. Fortunately, there are choices of down payment if you have great credit and high income. A mortgage rate is the rate of interest charged on a mortgage.

Your total interest on a $1,000,000.00 mortgage

These banks and brands are not responsible for ensuring that comments are answered or accurate. Amortization means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Most lenders want you to have at least 6-12 months of the mortgage payments in savings, which can equate to between $31,548-$63,096, depending on your loan terms. Lets imagine you want a 1 million dollar home and can afford a 20% down payment. Based on current interest rates, your monthly payments would likely land up around $4,500 . Shop around for a lower interest rate.Different lenders offer varying interest rates.

What income do you need for a $800000 mortgage?

Connect with vetted lenders quickly through this free online marketplace. Preapproval in minutes and closing in as little as 3 weeks with no origination fees.

Loss of tax deduction—Borrowers in the U.S. can deduct mortgage interest costs from their taxes. However, only taxpayers who itemize can take advantage of this benefit. Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Home insurance—an insurance policy that protects the owner from accidents that may happen to their real estate properties. Home insurance can also contain personal liability coverage, which protects against lawsuits involving injuries that occur on and off the property.

How much income do you need to buy a $600000 house?

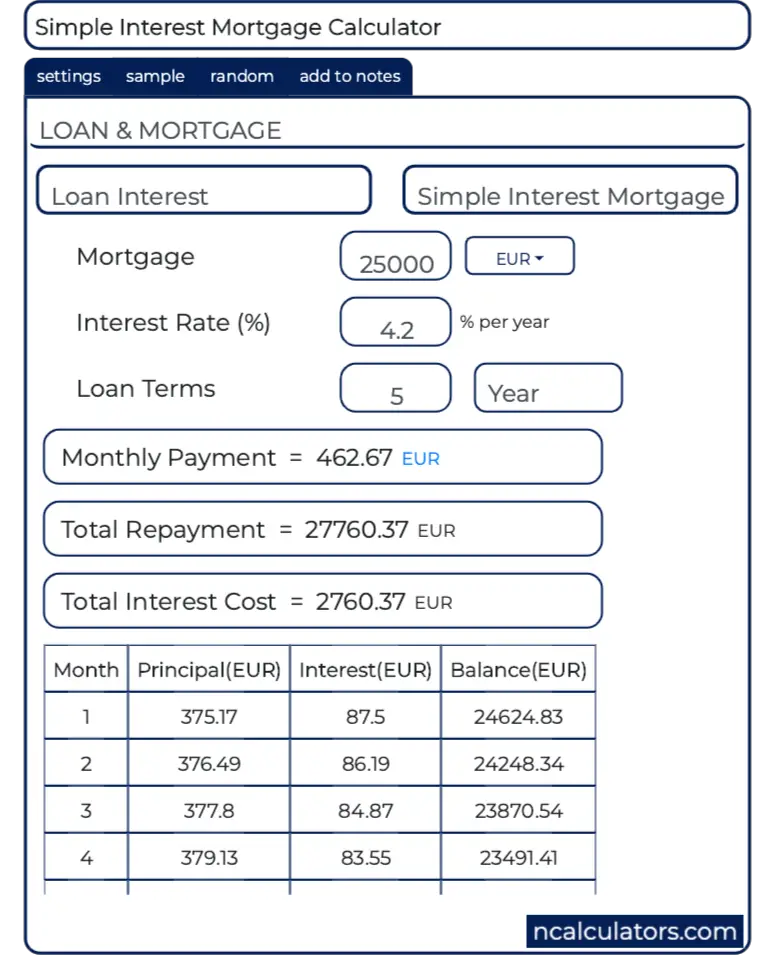

However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. That said, purchasing a $1 million house might be a poor financial decision if you can't afford a down payment of at least 20%. Note that this requirement comes in addition to the cash you’ll need to cover your down payment and closing costs. Consequently, you could need to save up a total of at least $255,771 to get approved for a mortgage on a million-dollar home. To help you calculate this figure, we’ve created a handy mortgage calculator.

The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan. As a rule of thumb, a million-dollar purchase price will require a jumbo loan. To get a jumbo loan, you typically need a credit score of 700 or higher.

If you’re unsure, it might help to speak with a financial advisor who can work to achieve the right investments for you.Finding a qualified financial advisor doesn’t have to be hard. The annuity would have paid you $8 million by the time you turned 95. The S&P 500 index fund would have returned $19.9 million with which to start your retirement. Sometimes the guarantee isn’t always the right play, but the answer is always going to depend on your specific financial situation. Georgia and New York happen to be two states where residents often win jackpots. With 22 other winning tickets that won between $10,000 and $1 million, it is no wonder why so many people dream of striking it rich by playing Mega Millions in Atlanta.

Many first-time homebuyers take advantage of this opportunity and set up RRSP accounts well in advance, with the intention to reap the rewards when it is time to purchase real estate. A mortgage payment calculator helps you determine how much you will need to pay each month to pay off your mortgage loan by a specific date. Don’t pay PMI.If your down payment is less than 20% of the home’s price, most lenders will require that you pay private mortgage insurance. To avoid this extra fee, you can always try to reach that 20% threshold. Buy points.Discount points, also known as prepaid points, help lower your interest rate, thus reducing your monthly mortgage bill. The downside is that you’ll need to pay for these points upfront, but they may be worth it.

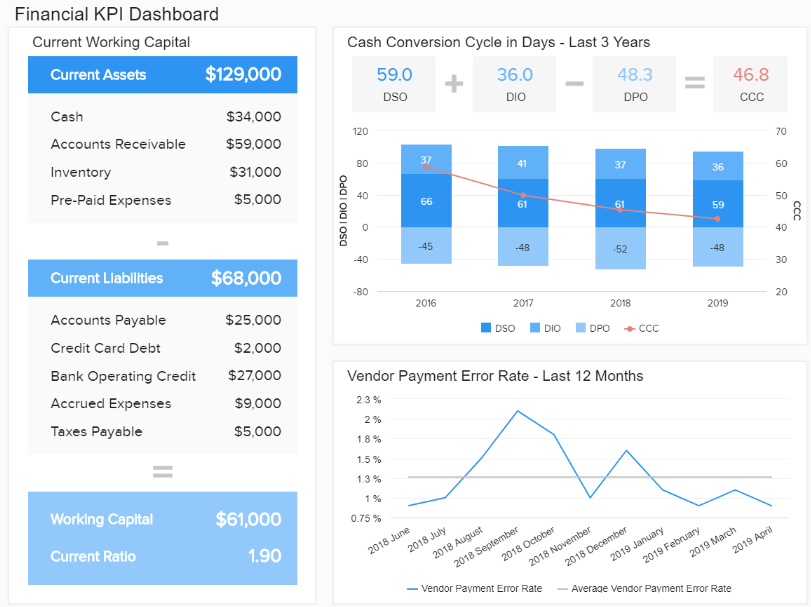

They are a bit more lenient when they consider these other expenses and look for ratios near 40% (32% + 8% to cover all the costs). Homeowners insurance premiums are typically included in your monthly mortgage payment, as are property taxes and private mortgage insurance fees. The lender will hold those funds in escrow and then pay the bills on your behalf when they come due. Enter the loan’s interest rate if it doesn’t come with any fees under Interest rate. Note that your monthly mortgage payments will vary depending on your interest rate, taxes, PMI costs and other related fees. If you have this information available, you can enter the annual percentage rate , which includes interest and fees combined.

Some people form the habit of paying extra every month, while others pay extra whenever they can. There are optional inputs in the Mortgage Calculator to include many extra payments, and it can be helpful to compare the results of supplementing mortgages with or without extra payments. Private mortgage insurance —protects the mortgage lender if the borrower is unable to repay the loan. In the U.S. specifically, if the down payment is less than 20% of the property's value, the lender will normally require the borrower to purchase PMI until the loan-to-value ratio reaches 80% or 78%.

Annual HOA fees usually amount to less than one percent of the property value. A jumbo loan is a type of financing where the loan amount is higher than the conforming loan limits set by the Federal Housing Finance Agency . The 2022 loan limit on conforming loans for 1-unit properties is $647,200 in most areas and $970,800 in high-cost areas. When attempting to determine how much mortgage you can afford, a general guideline is to multiply your income by at least 2.5 or 3 to get an idea of the maximum housing price you can afford. If you earn approximately $100,000, the maximum price you would be able to afford would be roughly $300,000.

Every annuity will offer rates of return that differ based on companies and their individual products. In particular, companies calculate lifetime annuities and fixed-term annuities very differently. Lifetime annuities work differently because the company doesn’t know how long it will make payments, so the value of the annuity is based on interest rates and life expectancy. The amount you collect from an annuity depends on when you invest, the return your specific annuity offers and the details of your particular contract.

Otherwise, the lottery company will pay out your winnings in installments over 29 years. This chart explains what percentage of your prize each installment is, so you can see how much of each check goes toward state and federal taxes. Mortgage refinance is the process of replacing your current mortgage with a new loan. Often people do this to get better borrowing terms like lower interest rates. Refinancing requires a new loan application with your existing lender or a new one. Your lender will then re-evaluate your credit history and financial situation.

There’s no magic formula that says you need X income to afford a $1 million house. While a palatial country estate might not be subject to any HOA regulations, a house in a luxury neighborhood could require residents to pony up $1,000 or more in fees every month. Most personal finance experts recommend setting aside 1%–4% of your home's value annually to cover the cost of maintenance and repairs. That equates to as much as $40,000 for a million-dollar home, not including the price of any additional renovation projects you plan to undertake. Property taxes are levied and collected at the local level, typically by your city or county government — and sometimes both.