Table of Content

In fact, the monthly payment on a $1 million loan will be enough to make you wonder if you should have just bought a house that was half as expensive. "As temperatures dip this winter, my administration is committed to making sure all New Yorkers are able to heat their homes," Governor Hochul said. Over 30 years, you would collect more than $8 million from this contract. On the other hand, the S&P 500 generates an average return of around 10.5%. If you took that same $1 million and put it in an S&P 500 index fund for 30 years, with a 10.5% annual return, you would have $19.9 million in the bank. In this case, you would buy the annuity for a single payment of $1 million.

This is why most people's homes cost a fraction of this amount. It is important to remember that most conventional loans have a maximum amount that can be borrowed. According to BankRate, the maximum amount is $484,850 as of 2019, although in some specific locations, the amount available rises to over $700,000.

What Is The Current Interest Rate On An Fha Mortgage

Annual homeowners insurance premiums could cost $3,500–$5,000 on a $1 million house, but rates will vary tremendously based on the size, age, and condition of your home. If you put less money down, your monthly payment will go up, and you'll pay more interest over the long term. Know how much you might pay each month on your $1,000,000.00 mortgage — including how much of your payment goes toward your interest over the principal — when shopping for a lender. Estimate your monthly loan repayments on a $1,000,000.00 mortgage at 7.00% fixed interest with our amortization schedule over 15 and 30 years.

Youll also need to provide proof of legal documents, such as your business license and articles of incorporation. But the housing market is currently hot in certain areas, like in Suffolk County, home to the capital city of Boston, where the median home value is $496,500. Despite those numbers, New York still contains the largest city in the U.S. by population. After New Yorks five boroughs, most of the population is housed in the counties surrounding New York and Long Island.

Example Mortgages On A 1 Million Dollar Home

Unfortunately, you'll have to pay taxes on that interest annually and will likely end up paying more in taxes over 29 years than if you'd taken an annuity payout. However, choosing a lump sum may make sense if you want complete control over how your money is invested and aren't afraid of losing some of it. Most jackpot winners choose a lump sum payment, usually paid over several years. If you select a lump sum payment, you will receive an estimated $1 million as cash and have to decide how to invest it.

This means you’ll need at least $200,000-$300,000 in the bank. Bankrate Mortgage Bankrate Mortgage Refinance is a marketplace for homeowners interested in viewing current mortgage refinance rates from competing lenders. From one single webpage, borrowers can access one of the most comprehensive selection of loan offers available, from a large network of financial entities.

Lump-Sum Payout and Annuity Payout Calculator for Megamillions, Powerball, Lotto, and Lottery Winnings

This means that the annuity provider would add, for example, 3% compounded interest to your annuity every year starting when you bought it. Your annuity would continue to collect interest while you collect payments, and would end once you have received back the full value of the principal and the interest. Generally speaking, most people will need to make a salary of roughly $220,000 per year to afford a 1 million dollar home.

From there, you can use Forbes online calculator to find out how to figure out how much house you can afford and calculate the monthly mortgage fees. In order to prepare yourself financially, you must be wondering “how much can I afford to pay for a house? If you want the million dollar home, how much house can I buy may also depend on how much cash you’ll have leftover after the sale.

How to Afford a Million Dollar Home

If you’re hoping to buy a home, weeks or months could pass before you find a house and negotiate your way to an accepted offer. But mortgage pre-approval does not last indefinitely, since your financial circumstances could change by the time you close your real estate deal. As such, you’ll want to know how long pre-approval lasts before it expires. A mortgage is a loan to help you cover the cost of buying a home. It provides a general estimate of possible mortgage payment and/or closing cost amounts and is provided for preliminary informational purposes only. Your own mortgage payment and closing cost amounts will likely differ based on your own circumstances.

So if you bought a $1 million home, you'd probably take out a mortgage for around $800,000 and put at least $200,000 down. It could take a long time to come up with such a large down payment. Of course, these numbers are just averages—you might end up paying less or more than that depending on where you live and what type of mortgage terms you get. So if you want to know exactly how much your monthly payments will be, talk to an experienced broker or lender who can help you find the best deal for your budget. Million dollar mortgages are often considered as necessarily luxurious, but this is actually not the case. Let’s see if we can figure out a way to calculate a 4 Million Dollar Mortgage monthly payment.

A lump-sum payment is when you make a one-time payment toward your mortgage, in addition to your regular payments. How much of a lump sum payment you can make without penalty depends on the original mortgage principal amount. Long-term mortgages typically have higher rates but offer more protection against rising interest rates. Penalties for breaking a long-term mortgage can be higher for this type of term. Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. Your business credit score will also be taken into consideration when loan officers review your application.

There’s no magic formula that says you need X income to afford a $1 million house. While a palatial country estate might not be subject to any HOA regulations, a house in a luxury neighborhood could require residents to pony up $1,000 or more in fees every month. Most personal finance experts recommend setting aside 1%–4% of your home's value annually to cover the cost of maintenance and repairs. That equates to as much as $40,000 for a million-dollar home, not including the price of any additional renovation projects you plan to undertake. Property taxes are levied and collected at the local level, typically by your city or county government — and sometimes both.

Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes. On a 30-year $1,000,000.00 mortgage with a 7.00% fixed interest rate, you may pay $1,395,088.98 in interest over the life of your loan. Fill out the form and click on “Calculate” to see yourestimated monthly payment.

The more reserves you have, the better your chances of getting approved to buy a million-dollar home. Assuming you have the cash and can prove it, now it comes down to your income and debt ratio. If you dont work, but rather live off your investments, you may be able to use that money as your income. Basically the lender needs to see that you can afford the very large mortgage payment.

Buy Your Dream Home, Get 1% Cash Back.

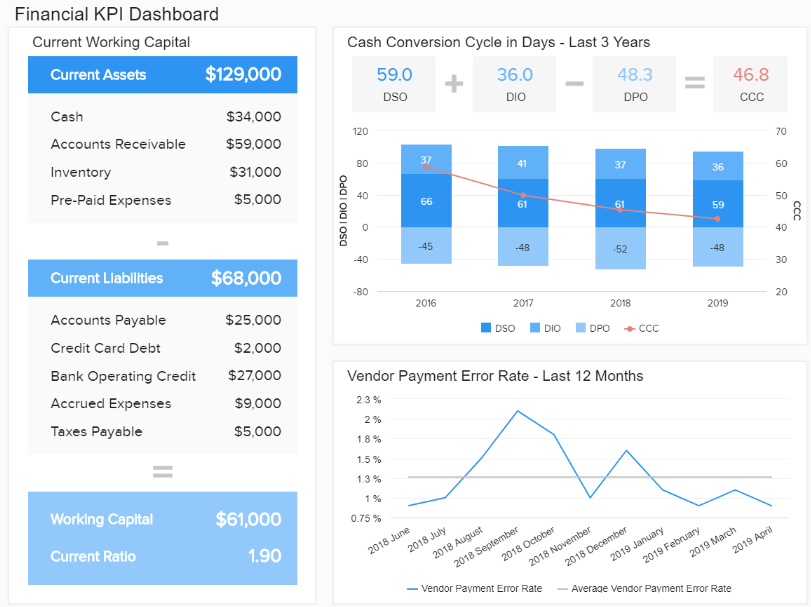

You may not qualify with any lenders if your monthly mortgage payment surpasses 28% of your income. Based on how much should you spend on your mortgage, your monthly payment could only be $469 per month. You would need a considerably high down payment saved or a very cheap home for around $60,000. To afford a $1 million home you need a minimum annual income of $200,000 to $225,000. You'll also need to have enough money saved for the down payment and closing costs, which can add up to over 20% of the purchase price. It's essential to consider two factors when calculating how much money a winner will receive from a lottery win—the payout and whether you want an annuity payout.

No comments:

Post a Comment